Zakat

Zakat is a required form of charity in Islam

The word Zakat comes from Arabic and carries meanings such as purification and growth.

Muslims give Zakat as an act of worship and as a way to support people in need.

Zakat is only required when a person’s extra savings reach a minimum amount called the niṣāb and remain above it for one lunar year.

What is the Niṣāb?

The niṣāb is the minimum amount of wealth a person must have before Zakat becomes obligatory. It is traditionally calculated using the value of gold or silver.

The niṣāb is originally defined in weight, not money. Islamic sources specify the niṣāb using gold and silver.

Classical Islamic measurements:

- 20 gold dinars ≈ 87.48 g of gold

- 200 silver dirhams ≈ 612.36 g of silver

In modern practice, these weights are converted into local currency using current market prices.

These weights are fixed, but their currency value changes over time.

- If your savings equal or exceed about 87.5 g of gold, the gold niṣāb is reached

- If your savings equal or exceed about 612 g of silver, the silver niṣāb is reached

Different scholars use gold or silver as the reference, which is why you may see two different niṣāb values.

Approximate Values (2026)

- Silver niṣāb (approximate): $2,500 USD

- Gold niṣāb (approximate): $18,000 USD

Some scholars use the silver standard, while others use the gold standard.

This difference can affect whether Zakat is due.

These values are approximate and can change depending on market prices.

How Much is Zakat?

For common "zakatable" wealth such as cash, savings, and similar assets, the Zakat rate is:

2.5% of Zakatable wealth

Zakat applies only if:

- The niṣāb is reached

- The wealth is surplus (not needed for daily living)

- One full lunar year has passed

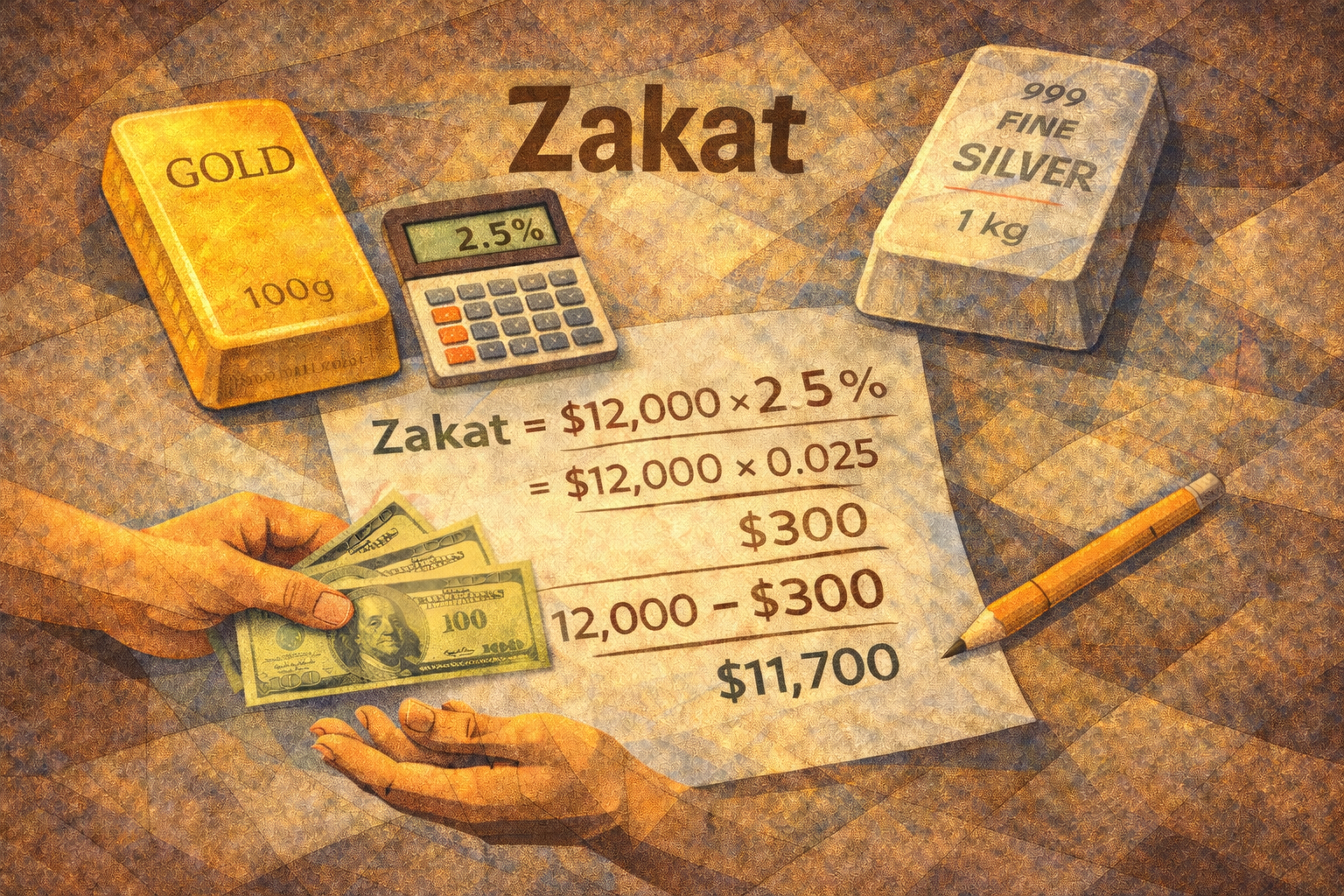

Real-World Example

Example:

Ahmed has $12,000 in savings.

Step 1: Compare Savings to Niṣāb

- Compared to silver niṣāb ($2,500)

-

$12,000 is above the threshold → Zakat applies using the silver standard

-

Compared to gold niṣāb ($18,000)

- $12,000 is below the threshold → Zakat does not apply using the gold standard

Step 2: Calculate Zakat

Zakat = 2.5% of savings = $12,000 × 0.025 = $300

Zakat due: $300 USD

$11,700 stays with Ahmed.

Where Does Zakat Go?

Zakat is given to specific groups defined in Islamic teachings, including:

- The poor and needy

- People in debt

- Travelers in difficulty

- Other eligible recipients

Zakat is considered a right of the poor, not a favor.

Key Takeaways

- Zakat is not paid on all money, only surplus savings

- Eligibility depends on reaching the niṣāb

- The standard rate is 2.5%

- Zakat supports both spiritual growth and social responsibility

Disclaimer:

Simple educational overview!

Detailed rulings may vary depending on:

-individual circumstances

-scholarly opinions

ISLAM-EDUCATION.COM